Harris County Tax Office Title Transfer

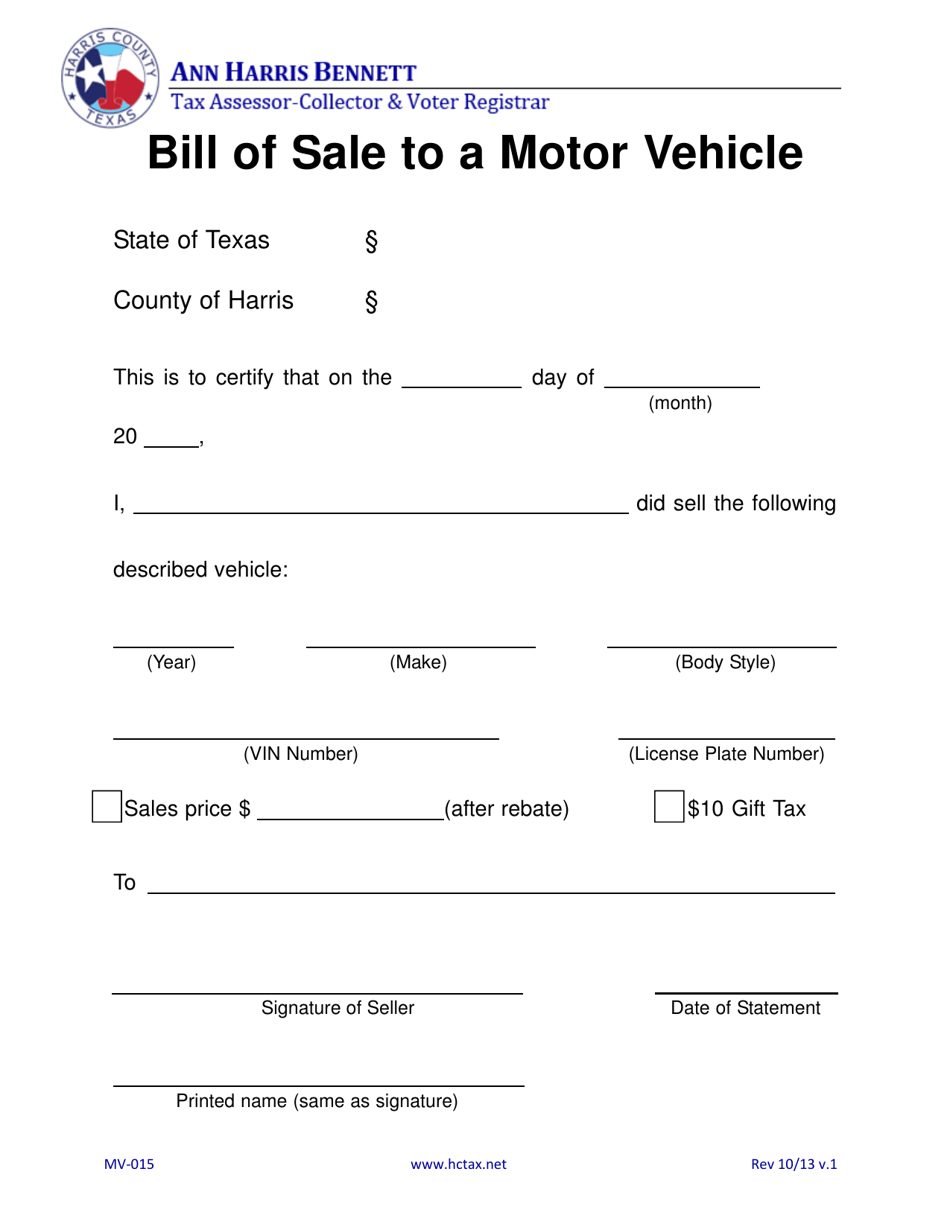

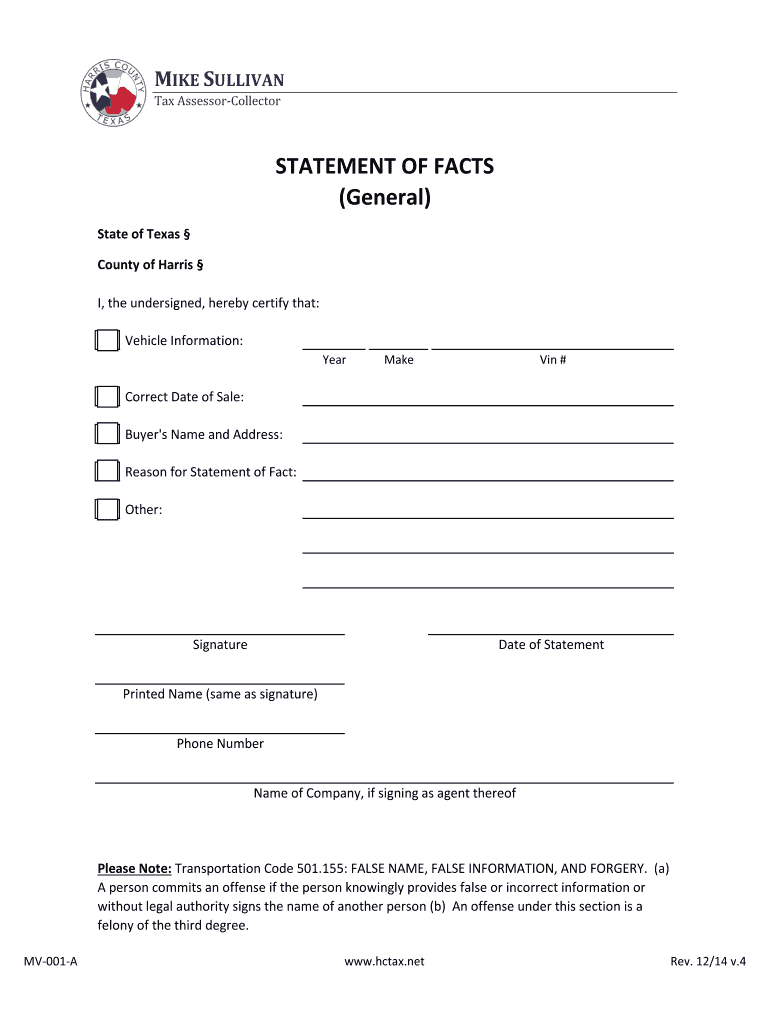

Both signed documents must be given to the purchaser along with the registration receipt.

Harris county tax office title transfer. County tax assessor collector offices provide most vehicle title and registration services including. Change of address on motor vehicle records. If buying from an individual have the seller accompany you to the county tax office to avoid unwanted surprises.

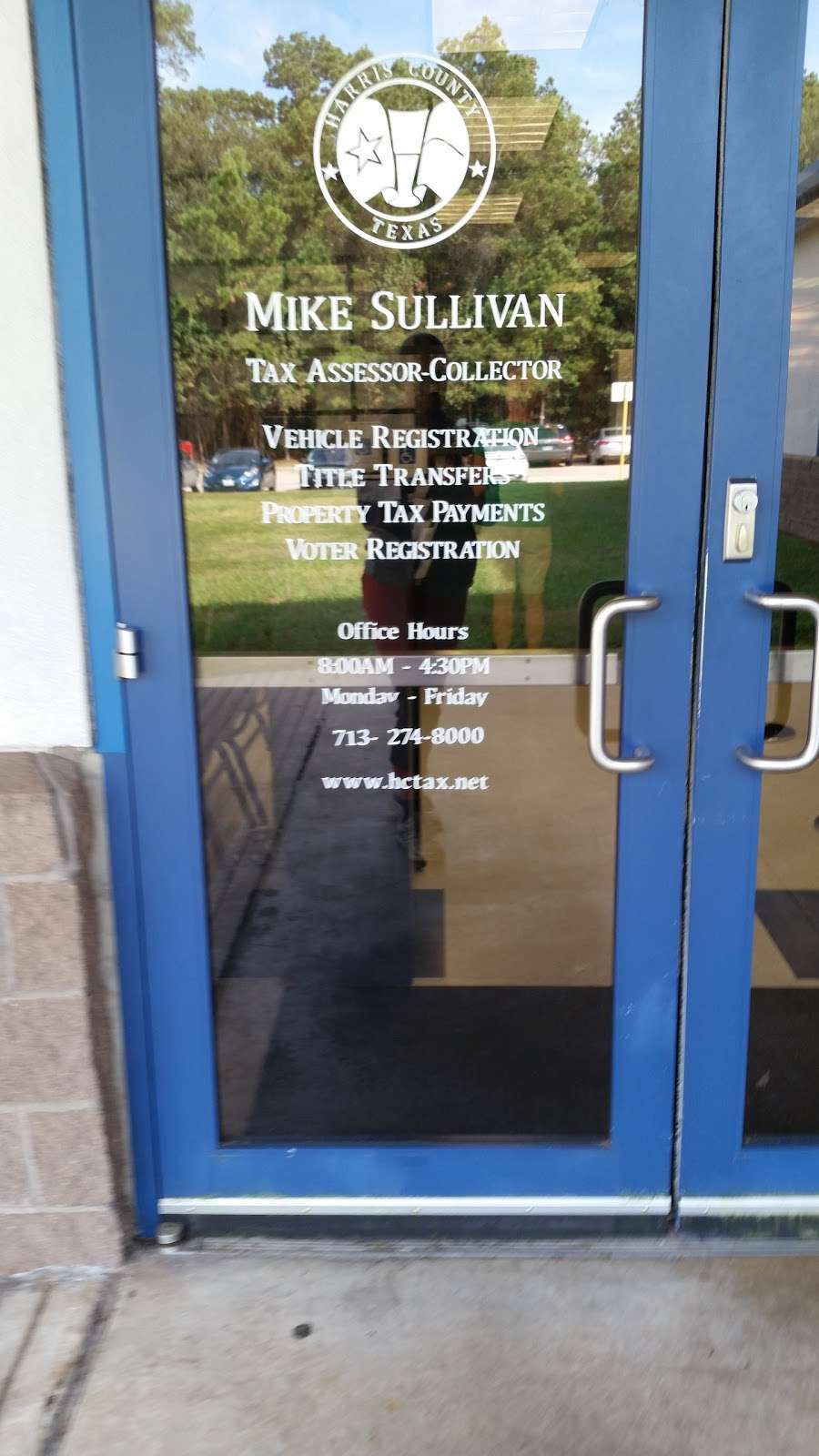

The online appointment system is not available to dealers and title services. Harris county has approximately 2 800 automobile dealers which includes 395 franchise dealers. Registration renewals license plates and registration stickers vehicle title transfers.

The same guidelines that were previously in place must still be followed. House bill 3521 is also known as the blando act. Ann harris bennett tax assessor collector voter registrar attn.

As of january 1 2000 all vehicle title service transactions performed at the harris county tax office must be in accordance with texas house bill 3521. The harris county tax assessor collector s office performs approximately 3 2 million vehicle registrations and 940 000 vehicle title transfers in harris county each year. The harris county tax office has resumed all services by appointment only and mail.

Before submitting the title application a tax office representative can tell you if the title being signed over to you is correct and if it has any salvage or legal issues. Each appointment allows for a maximum of 3 transactions. Or to renew registration or a permanent disabled parking placard.

Box 4089 houston texas 77210 4089. You may also mail the application to. The purpose of the waiver is to prevent customers from having to physically visit a county tax assessor collector office to obtain initial registration to obtain a 30 day temporary permit to transfer title.