Home Office Deduction Covid

Home office deduction in 2020 what you need to know about this valuable tax deduction in the time of coronavirus.

Home office deduction covid. The only workers who could potentially pick up a home office deduction for the first time under the virus induced remote work environment are partners who formerly worked out of a joint office and. We understand that due to covid 19 your working arrangements may have changed. One of the significant social side effects of the covid 19.

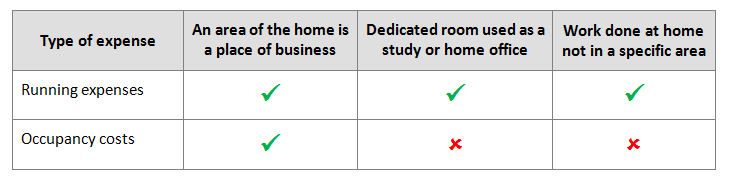

With more people working from home than ever before some taxpayers may be wondering if they can claim a home office deduction when they file their 2020 tax return next year. Tracking these expenses can be challenging so we have introduced a temporary shortcut method. Common covid 19 home office deduction questions although there are tax deductions in place for people working from home they won t apply to most remote employees during this pandemic.

Irs tax tip 2020 98 august 6 2020. The easiest way to calculate your home office tax deduction is called the simplified method the irs allows taxpayers to deduct 5 per square foot up to 300 square feet of home used in. Claiming home office deductions during covid 19 22 may 2020 as the covid 19 pandemic shifts employees from their offices to their homes many employees are left wondering whether they ll now be able to deduct home office expenses from their employment income in their 2020 tax return.

While congress has made some changes in tax law due to the coronavirus home office deductions and other miscellaneous itemized deductions were not included in. The home office deduction is only available to self employed people who use their home regularly and exclusively for business during the tax year. Here are some things to help taxpayers understand the home office deduction.

If you have been working from home you may have expenses you can claim a deduction for at tax time. A months long covid 19 lockdown means the majority of canada s workforce that has transitioned from an office space to a makeshift remote set up could be eligible for a work from home tax deduction.