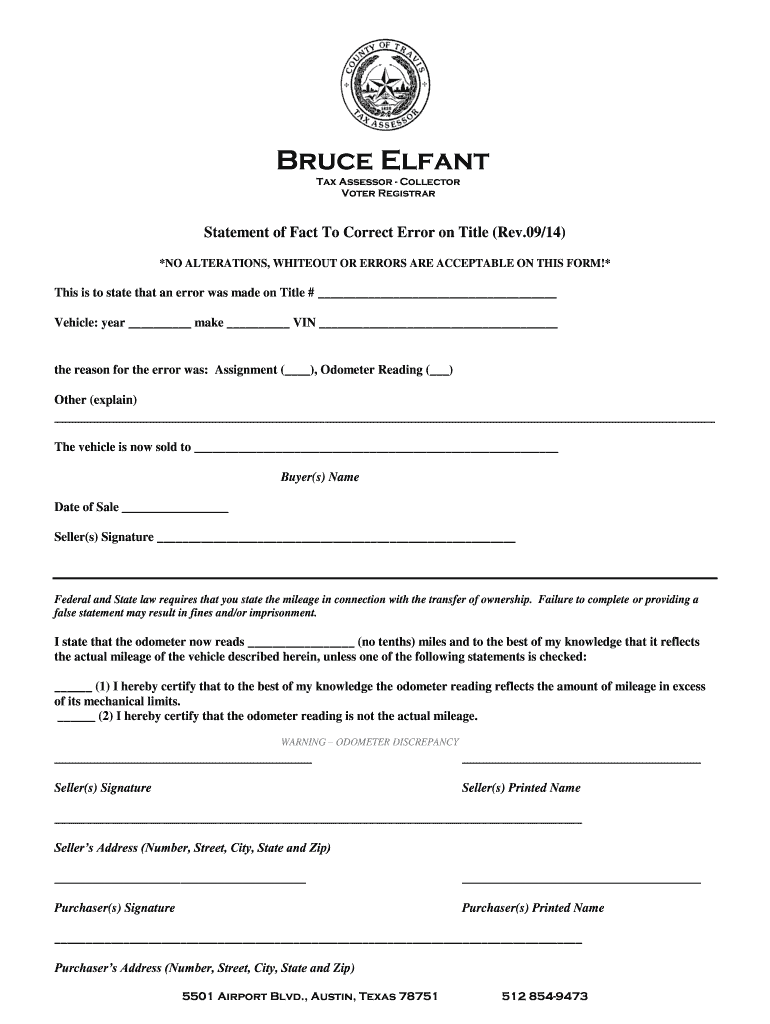

Travis County Tax Office Title Transfer

Vehicle title transfer buying a vehicle if buying from an individual have the seller accompany you to the county tax office to avoid unwanted surprises.

Travis county tax office title transfer. Change of address on motor vehicle records. Travis county tax office website the tax office collects fees for a variety of state and local government agencies and proudly registers voters in travis county. File a vehicle transfer notification within 30 days of the sale date to remove your liability for anything the purchaser may do with the vehicle.

A driver s license or state identification certificate issued by a state or territory of the united states. Application for a certified copy of title vtr 34 texas motor vehicle transfer notification vtr 346. County tax assessor collector offices provide most vehicle title and registration services including.

Travis county tax office website the tax office collects fees for a variety of state and local government agencies and proudly registers voters in travis county. Travis county tax office website the tax office collects fees for a variety of state and local government agencies and proudly registers voters in travis county. Before submitting the title application a tax office representative can tell you if the title being signed over to you is correct and if it has any salvage or legal issues.

Vehicle title transfers the tax office collects fees for a variety of state and local government agencies and proudly registers voters in travis county. Vehicle title transfers giving or receiving a vehicle as a gift. Sign the back of the title and record the odometer reading.

Schedule your appointment. Non fee license plates such as purple heart and disabled veterans license plates. Travis county tax office vehicle title transfer identification requirements you must bring one of the following forms of government issued photo identification to title a vehicle in texas.

Non fee license plates such as purple heart and disabled veterans license plates. You must arrive at the tax office by 4 p m. For your protection we recommend that you and the buyer come to the tax office together to process the title transaction.